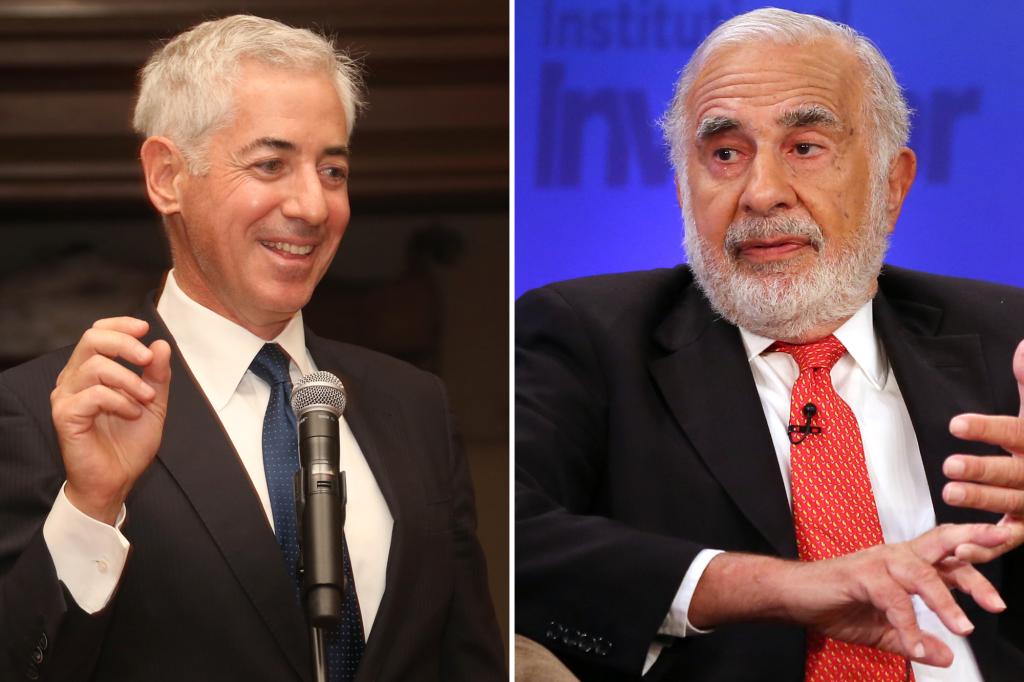

Bill Ackman twisted the knife into old rival Carl Icahn on Wednesday with a broadside attack that questioned the valuation of the famed activist investor’s flagship firm, whose company has become the target of short-seller Hindenburg Research.

In a withering and lengthy Twitter post, Ackman wrote he was “fascinated” by the situation between the short seller and Icahn Enterprises (IEP), while noting that the company’s premium had been sustained by a large dividend yield.

“The yield is generated by returning capital to outside shareholders, which is in turn funded by the company selling stock to investors,” Ackman said, adding the system is highly dependent on the “maintenance of the premium and the placidity of Icahn’s margin lender(s).”

Ackman, the founder and chief executive of hedge fund Pershing Square Capital Management, said the situation had jeopardized Icahn’s fund.

“$IEP reminds me somewhat of Archegos where the swap counterparties were comforted by each having relatively smaller exposures to the situation,” Ackman said, referring to Bill Hwang’s firm that blew up in 2021.

“All it takes is for one lender to break ranks and liquidate shares or attempt to hedge, before the house comes falling down,” he added. “Here, the patsy is the last lender to liquidate.”

Shares of Icahn Enterprises have dropped more than 50% since the Hindenburg report was published May 2.

The stock fell more than 13% on Wednesday, reaching the lowest level in more than 14 years.

Icahn has personally lost $15 billion – tanking his net worth from $25 billion to $10 billion.

That scathing Twitter post stunned Icahn, The Post has learned.

“I don’t know what I’m going to do about this,” Icahn told The Post shortly after the tweet went live.

Icahn, 87, refused to delve into why Ackman would make such a public attack, suggesting he could release a statement later.

A spokesperson for Bill Ackman’s fund Pershing Square Capital Management declined further comment.

Ackman concluded the tweet by referencing one of Icahn’s favorite sayings, “If you want a friend, get a dog.”

Then the Icahn nemesis took it a step further: “Over his storied career, Icahn has made many enemies. I don’t know that he has any real friends. He could use one here.”

The short seller report pointed out the current dividend yield for the Icahn’s firm is among the richest on Wall Street at 15% — and claimed it “is entirely unsupported by IEP’s cash flow and investment performance, which has been negative for years.”

Icahn has vowed to fight back against Hindenburg, which accused IEP of overvaluing its holdings and relying on a “Ponzi-like” structure to pay dividends.

Icahn has called Hindenburg’s report “self-serving” and reiterated his defense of the company.

“If you’re going to be bothered by this, you shouldn’t be in this business,” Icahn told Bloomberg Tuesday.

On May 10, IEP said it was contacted by US prosecutors, and it posted a surprise quarterly loss in the first quarter.

The bad blood between the moguls goes back two decades after a dispute over a 2003 deal involving Hallwood Realty.

It was ratcheted up in 2013 when Ackman and Icahn got into a now-infamous feud on CNBC, with both men hurling insults. Ackman lost money on his $1 billion short bet against Icahn’s Herbalife.

“This is not a guy who keeps his word. This is a guy who takes advantage of little people,” Ackman said of Icahn at the time.

The two seemingly buried the hatchet a year later when they were photographed hugging at an investors’ conference.

𝗖𝗿𝗲𝗱𝗶𝘁𝘀, 𝗖𝗼𝗽𝘆𝗿𝗶𝗴𝗵𝘁 & 𝗖𝗼𝘂𝗿𝘁𝗲𝘀𝘆: nypost.com

𝗙𝗼𝗿 𝗮𝗻𝘆 𝗰𝗼𝗺𝗽𝗹𝗮𝗶𝗻𝘁𝘀 𝗿𝗲𝗴𝗮𝗿𝗱𝗶𝗻𝗴 𝗗𝗠𝗖𝗔,

𝗣𝗹𝗲𝗮𝘀𝗲 𝘀𝗲𝗻𝗱 𝘂𝘀 𝗮𝗻 𝗲𝗺𝗮𝗶𝗹 𝗮𝘁 dmca@enspirers.com