Former President Donald Trump and his social media platform could reap a $100 million windfall as a result of his historic, precedent-setting criminal indictment by the Manhattan District Attorney’s Office.

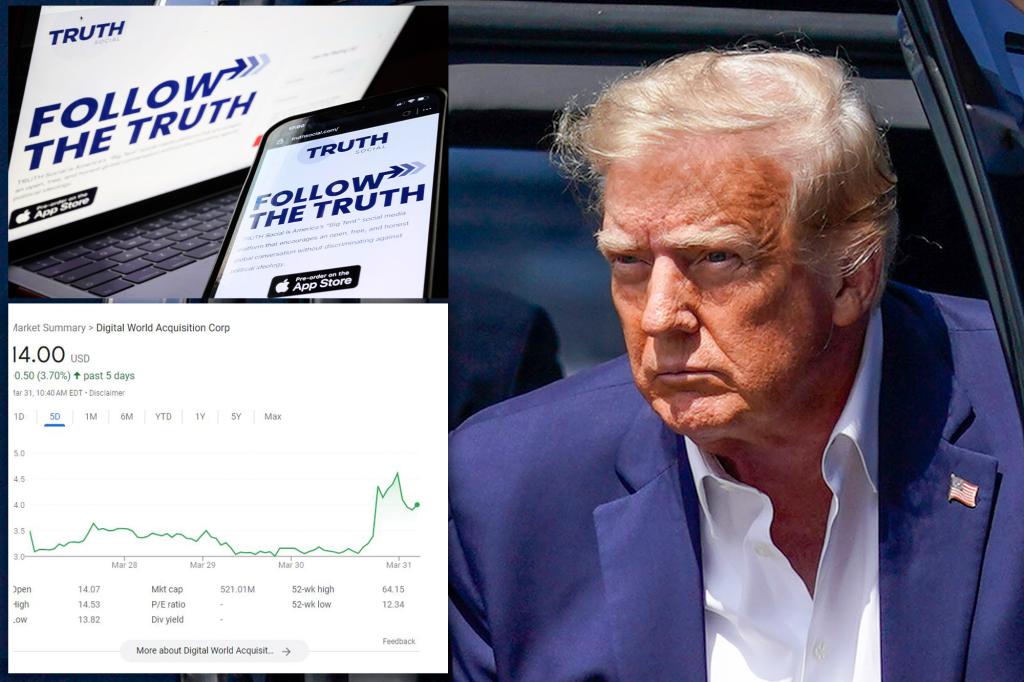

Shares of the special purpose acquisition company (SPAC) that was created to take Trump’s media company public soared by as much as 10% in pre-market trading on Friday — less than 24 hours after news of the indictment broke.

The stock price of Digital World Acquisition Corp, which closed at $13.06 on Thursday, was trading as high as $14.44 during Friday’s session on Wall Street.

When DWAC and Trump Media and Technology Group eventually merge, the former president is in position to hold 73.3 million shares, according to Securities and Exchange Commission filings cited by Forbes.

At $13.06 a share, Trump’s stake is believed to be worth an estimated $957 million.

With the stock price ticking up to $14.44 a share during mid-day trading on Friday, the value of Trump’s stake jumped to $1.058 billion — a gain of more than $100 million.

The merger agreement calls for Trump and other shareholders receiving bonus shares if the stock price of the newly merged entity hovers above $15 a share for a set period of time, according to Forbes.

In practical terms, Trump would receive an additional 12.8 million more shares.

Follow The Post’s latest coverage on Trump’s indictment

At $15 a share, that’s a $192 million bump in his net worth.

But several legal and regulatory hurdles remain before Trump could get his hands on the money.

The Justice Department and the Securities and Exchange Commission are investigating whether DWAC broke the rules by negotiating the acquisition of Trump’s firm before the SPAC began offering shares to the public.

Trump’s firm has vowed to cooperate with “oversight that supports the SEC’s important mission of protecting retail investors.”

Last week, DWAC ousted its chief executive, Patrick Orlando, due to what the company called “unprecedented headwinds” faced by the firm.

Late last year, shareholders approved extending the deadline to close the deal to September 2023.

Around that time, DWAC’s chief financial officer and two independent directors left.

Trump’s indictment could be a boon to investors who are salivating at the thought that social media users will flock to Truth Social, the social media platform created by the former president, for his reaction to the dramatic news events.

Since word of the indictment leaked on Thursday, Trump has posted dozens of messages on his Truth Social account, which numbers more than 5 million followers.

TMTG’s founders launched the company as a way for Trump to connect with his followers after he was cut off from major social media platforms following the Jan. 6, 2021, attack on the US Capitol by his followers.

TMTG’s fortunes are tied to Trump, whom the company bills as its chief traffic driver.

But Trump has now returned to the platforms from which he was ousted.

He posted to Alphabet’s YouTube and Meta Platforms’ Facebook on March 17, the same day YouTube restored his channel.

Meta reinstated Trump’s Facebook and Instagram accounts earlier this year.

Trump’s Twitter account was reinstated in November by the platform’s new owner, Elon Musk, but Trump has yet to post there.

With Post Wires

𝗖𝗿𝗲𝗱𝗶𝘁𝘀, 𝗖𝗼𝗽𝘆𝗿𝗶𝗴𝗵𝘁 & 𝗖𝗼𝘂𝗿𝘁𝗲𝘀𝘆: nypost.com

𝗙𝗼𝗿 𝗮𝗻𝘆 𝗰𝗼𝗺𝗽𝗹𝗮𝗶𝗻𝘁𝘀 𝗿𝗲𝗴𝗮𝗿𝗱𝗶𝗻𝗴 𝗗𝗠𝗖𝗔,

𝗣𝗹𝗲𝗮𝘀𝗲 𝘀𝗲𝗻𝗱 𝘂𝘀 𝗮𝗻 𝗲𝗺𝗮𝗶𝗹 𝗮𝘁 dmca@enspirers.com